A Huge Investment Firm is Offering $610 Million for Nissan's HQ

A major Wall Street firm might purchase Nissan's HQ

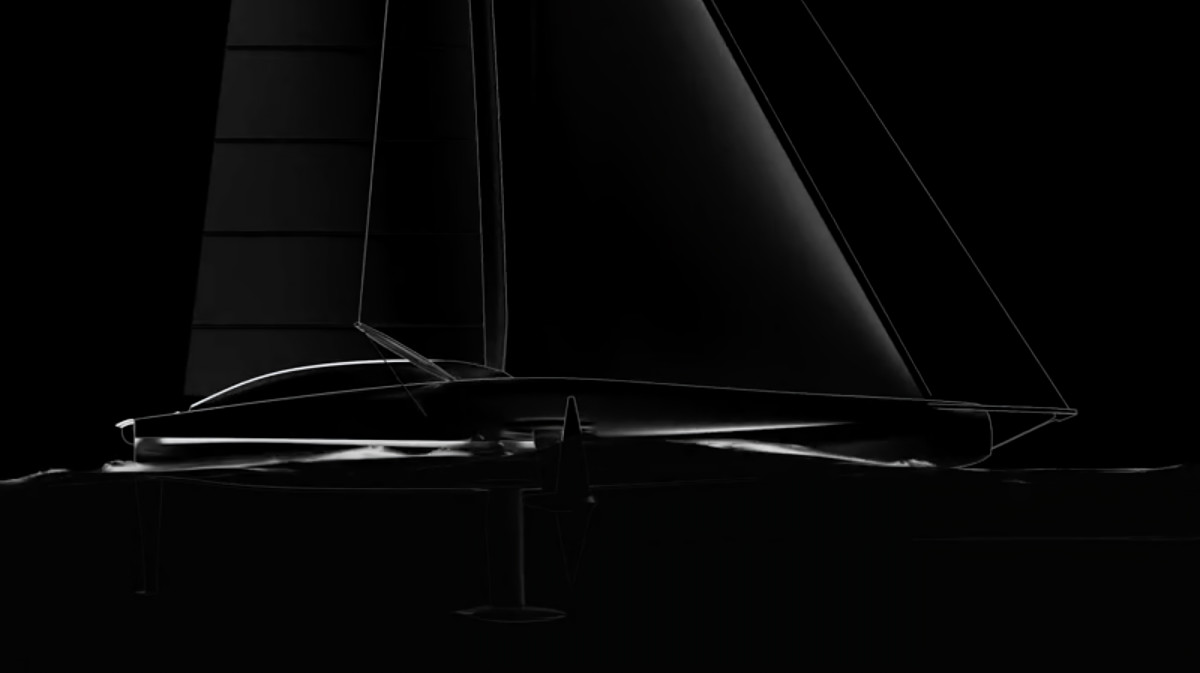

According to new reports from Reuters and Bloomberg, KKR & Co. has emerged as the top bidder for the headquarters of Japanese automaker Nissan. Represented through KJR Management, its Japanese real estate arm, the Hudson Yards-based firm offered around ¥90 billion ($610 million) for the Altima maker’s 22-story office building in the central business district of Yokohama, a port city just outside the southern tip of Tokyo.

The report denotes that KKR and KJR Management are looking at ways to raise money for the purchase, which may include the possibility of leasing office space to Nissan over a period of 10 years. However, discussions are still ongoing regarding a deal that isn't anywhere close to final just yet. Getty Images

Nissan's HQ sale is part of its cost-cutting plans

Discussions about a potential sale of its headquarters emerged in a Nikkei Asia report back in May 2025, where sources noted that it was listed on a list of assets designated to be sold by the end of the 2025-2026 fiscal year ending in March 2026. A local real estate agency valued the building at over ¥100 billion ($698 million), an amount it would use to cover the costs associated with plant reductions and restructuring.

“We plan to cover the restructuring costs through asset sales,” CEO Ivan Espinosa said, according to Nikkei Asia.

The report comes in a timely manner for both parties. The New York-based KKR already has a healthy portfolio that includes stakes in everything from Simon and Schuster to Safeway, but lately, it has been looking for private equity and real estate opportunities in Japan. Last year, its Co-Chief Executive Officer, Joseph Bae, said that Japan was the firm’s most active investment market outside the US. Getty Images

However, a $610 million sale of its HQ can't come any quicker for Nissan, as it is amidst the early stages of its Re:Nissan restructuring and corporate austerity plan. It aims to shed 20,000 jobs from its rolls and reduce its manufacturing footprint from 17 factories to 10. In addition, it predicts that it will lose ¥180 billion (~$1.21 billion) during the April-September 2025 period and an additional forecasted ¥300 billion (~$2.02 billion) hit from the Trump Administration's tariffs.

On June 30, it reported a significant loss of ¥115.7 billion ($782 million) during the first quarter of its fiscal year from April to June, marking the fourth straight quarter of losses for the automaker; a far cry from the profit of ¥28.5 billion they reported during the same period last year. But despite acknowledging that “the Q1 results were weak,” Nissan’s Chief Financial Officer Jeremie Papin noted that the Re:Nissan restructuring and corporate austerity program has been going well.

“We are advancing steadily with Re:Nissan, and that progress is encouraging,” Papin said. “At the same time, the magnitude of our challenge remains significant, as reflected in our Q1 results, which reinforces the urgency of continued, disciplined execution.”

Final thoughts

In corporate speak, Nissan is seeking a "sale-leaseback," which can unlock a quick and easy way to recover funds by leveraging the value of its real estate while retaining operational control. Essentially, they make a deal to sell the house without having to move out on the condition of paying rent.

Companies, big and small, do this all the time to reduce their physical footprint. For instance, the outdoor supply co-op REI entered into this kind of deal in February, selling its four Class A distribution center properties to New York-based real estate investment firm, Madison Capital, for $230 million.

In January, AT&T sold 74 properties across the country, encompassing over 13 million square feet of space to private real estate company Reign Capital in a deal that generated $850 million, while fashion giant Coach Inc. sold its headquarters in New York’s Hudson Yard in August 2016 for $707 million to an arm of German insurer Allianz. Whatever Nissan decides to go with, it is looking at a heck of a payday, which it needs to leverage to get ahead.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0